NYS Proposes Direct Deposit, Paycard Rule Changes

Update, September 14, 2016

The New York State Department of Labor (NYSDOL) has published the final version of this rule. You can read our summary here.

Big changes to paycard and direct deposit rules should put New York employers on notice.

On June 15, the New York State Department of Labor (NYSDOL) released a new proposal that could potentially overhaul the way employees opt into electronic forms of payment. The new rule would require employers to present workers with a new consent form including:

- An acknowledgment from the employer that they cannot legally require direct deposit or paycard use.

- Descriptions of all available payment methods in the employee’s preferred language.

- A statement affirming that workers will not be charged for trying to access their paycard wages.

The above can be presented as a paper form or electronically, so long as the employee is guaranteed ready access to the form afterwards. Additionally, employees must also be allowed to opt out of electronic forms of payment at any time. If the employee chooses to receive a paycard, they must be provided with a listing of locations where they can withdraw their funds for free or be provided a URL or phone number they can use to find one.

Old Forms to Be Invalidated

Significantly, the proposal states that any historic direct deposit or paycard acknowledgements will become invalid unless they meet the above requirements. As the requirements are unprecedented nationwide, it's likely that most New York employers will have to re-issue payment consent forms to their employees. The NYSDOL will give businesses six months after the publication of the final rule to get the forms signed. Once gathered, a form must be kept on record during a worker’s entire employment and for six years following their departure.

Ahead of the final rule’s effective date, which is currently unknown, the NYSDOL will publish a templated consent form that employers can use. The template will be compliant with all of the rule’s new requirements.

In addition to consent form changes, the proposal also tightens paycard rules substantially. Firstly, employers who choose to offer paycards must ensure that there is an ATM within “reasonable distance” of the employee’s workplace or home, a term intentionally left vague by the NYSDOL to reflect disparate travel distances in urban and rural New York. Further, that ATM must allow employees to withdraw their full pay at no cost at least once per pay period.

The law also provides that employers and paycard providers cannot charge users for any of the following:

- Account setup.

- Point of sale transactions.

- Overdrafts.

- Account inactivity.

- Maintenance.

- Customer service.

- Balance access.

- Replacement cards (at “reasonable intervals”).

- Requesting a written statement.

- Declined transactions.

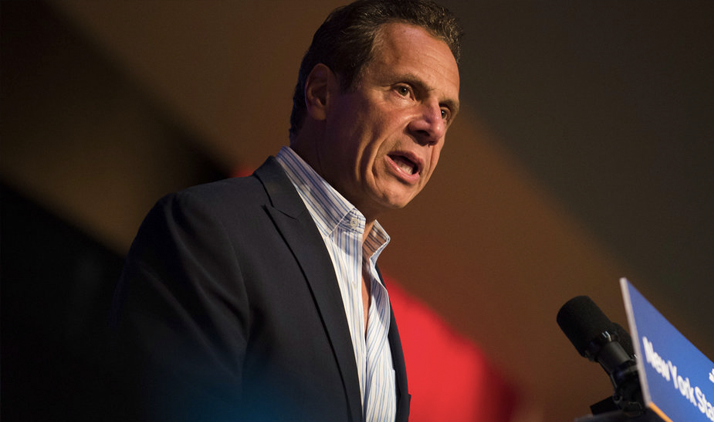

The NYSDOL’s proposal is the latest attempt by the agency to curb paycard misuse, a story the Namely team has reported. Paycard critics argue that the hidden fees associated with the cards often result in workers unfairly losing a sizeable share of their wages every month. New York Governor Andrew Cuomo went far enough as to publicly admonish paycard fees as “one of the more underhanded forms of wage theft.”

The proposal will be open to public comment until July 15, after which the NYSDOL will begin to finalize it. The Namely team will continue to monitor the rule’s status.

See how Namely's flexible solution will help you streamline your HR processes by having your people, payroll, and benefits info all in on place.

Get a demoGet the latest news from Namely about HR, Payroll, and Benefits.

Thanks for subscribing!

Get the latest news from Namely about HR, Payroll, and Benefits.

Thanks for subscribing!