New Massachusetts Paid Leave Regulations Released

Newly released paid leave regulations will soon make waves with Bay State residents and employers alike.

Last year, Massachusetts lawmakers signed off on one of the country's most generous paid family leave laws. But while the program’s benefits won’t be available until 2021, the first employer requirements take effect this summer.

The Massachusetts Department of Family and Medical Leave, the agency responsible for administering the program, recently published details regarding contribution rates, eligibility rules, and more. Below are the highlights from the release.

Payroll Contributions

Starting July 1, 2019, employers must begin withholding or paying family and medical leave contributions at a rate of 0.63 percent of employee wages. These withholdings share the same wage base as Social Security, meaning they only apply up to the first $132,900 of employee earnings. After the employee earns that amount, the withholding “turns off” for the remainder of the year.

Note that the 0.63 percent contribution rate is set to be revisited annually every October 1.

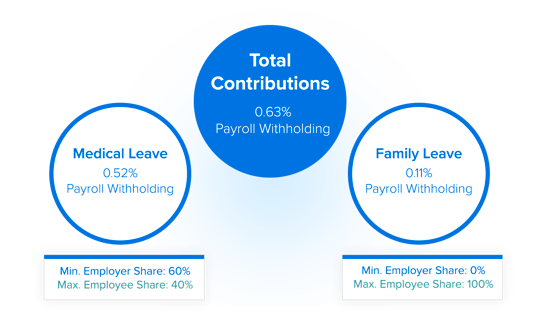

So who’s footing the bill, individuals or businesses? As is often the case in compliance, the answer is a resounding “it depends.” Of the overall 0.63 percent contribution rate, the majority is designated for medical leave and a smaller portion for family leave (see our illustration below). Depending on their employee headcount, companies may be required to cover a share of those costs:

- Businesses with 25 or more employees need to cover at least 60 percent of the medical leave portion of the contribution.

- Businesses with less than 25 employees are not required to cover medical leave contributions at all.

Notably, the state requires that 1099-MISC independent contractors be considered when determining whether a company is under or over the 25 employee threshold.

Here’s a visual representation of the employee/employer contribution breakdown for businesses with 25 or more employees. Pay particular attention to the separate withholding percentages for medical and family leave.

Massachusetts Paid Leave Contribution Breakdown

(Companies With 25+ Employees)

What if your company already offers paid leave benefits? In cases like these, the state can grant organizations a one-year exemption from having to fund the program. The catch? Your company's benefits need to be comparable or better than those provided by the state.

Eligibility and Benefits

Starting January 1, 2021, Massachusetts residents will be entitled to, in aggregate, up to 26 weeks of family and medical leave. Qualifying reasons and their associated maximum benefit periods are listed below.

|

||||||||||||

In order to qualify for the above benefits, an employee or independent contractor must have worked 15 weeks and earned at least $4,700 over the last twelve months. Paid leave benefits will be calculated as a percentage of the beneficiary's average weekly wage, with a maximum benefit of $850 per week. Individuals can calculate their weekly benefits by using this helpful state calculator.

Massachusetts’ new paid leave program isn’t just one of the country’s most generous, it’s also among the most administratively complex. Ahead of July 1, work closely with your payroll provider to ensure your withholding rules are current and compliant with the state’s new regulations.

The Namely team will continue monitoring the implementation of the state’s new paid leave program. Subscribe to our newsletter for weekly updates on HR, payroll, and benefits news across all 50 states.

See how Namely's flexible solution will help you streamline your HR processes by having your people, payroll, and benefits info all in on place.

Get a demoYou May Also Like

Get the latest news from Namely about HR, Payroll, and Benefits.

Thanks for subscribing!

Get the latest news from Namely about HR, Payroll, and Benefits.

Thanks for subscribing!