Everything to Know About the Form W-4

.jpg?width=110&name=IMG_7211%202%20(1).jpg)

Whether it’s a marriage or break up, people tend to share life updates on social media. Aside from the general public, there’s one other party that needs to be in the know: the Internal Revenue Service (IRS). Enter the Form W-4, the agency’s window into your employees’ lives.

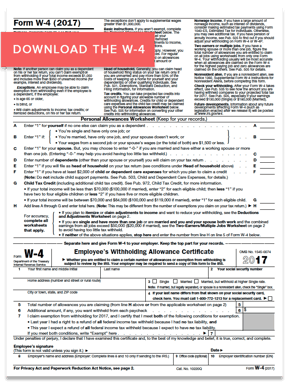

The W-4’s full name is the Employee’s Withholding Allowance Certificate. The purpose of the form is simply to ensure that the proper amount of federal income tax is withheld from individuals’ paychecks each pay period. The W-4 can accomplish that by being filed when employees start working, change their marital status, have a child, or change their allowances. Let’s break these events down one at a time and learn a little bit more about the W-4.

New Hires

All new hires are expected to complete a W-4 on or before their first day of work. Once they hand over a signed copy to HR, they are legally affirming the information provided. That information includes legal name, address, social security number, marital status, total number of allowances, additional federal tax withheld, and whether the employee is claiming exempt status. It’s important to note that being “exempt” does not mean federal wages won’t accrue, it just means federal tax won’t be withheld. Exempt employees still pay Medicare and Social Security taxes.

Marital Status

Hear wedding bells in the office? While they won’t care much for photos, the IRS will be eager to see the newly-wed’s completed Form W-4.

Why? It helps the agency place the individual’s income into the proper tax bracket. If both spouses make a good living, it may benefit them to file “married filing jointly” to avoid getting hit with what is referred to as the “marriage penalty.” This so-called penalty is when the combined incomes enter a bracket that exceeds the tax amount of filing single. Conversely, when spouses have disparate income, their updated bracket can save the couple some much needed funds—something called a “marriage bonus.” Because you should never give employees direct tax advice, direct them to this helpful withholding tool from the IRS.

So what exactly are allowances? Allowances are claims an employee can make to reduce their taxable income. For example, you can claim a child, dependent, spouse, and even yourself as an allowance. The W-4 explains these options in detail on the personal allowance worksheet. When you total that number up, it will be used when calculating your taxes in addition to your marital status. If you want to have as much federal tax withheld as possible, your filing would be “Single – 0.” That means you are claiming a “single” marital status with no allowances. If an employee fails to provide a W-4, then an employer would withhold as if the employee was single with no allowances.

Children

Are baby pictures starting to make the rounds? Don’t fret—the IRS doesn’t require a new Form W-4 when allowances increase. If the child is listed as an allowance, however, note that when he or she loses that status, the respective parent’s allowances will subsequently decrease—and a new W-4 will need to be filed within 10 days.

Here’s a rule of thumb when managing allowances: if the IRS is entitled to more, they want to know immediately. There’s one exception to this, however—if the loss of a dependent is due to death, a new W-4 does not need to be filed until January 1 of the following year.

Thankfully, employers are not required to monitor their employees for changes that decrease allowances. The only requirement that employers do need to follow is implementing any new or updated Form W-4s by the first pay period after they’re provided. You’ll also be responsible for keeping a copy of the forms for at least four years after the employee filed with that information.

The Worksheet

The second page of the Form W-4 includes the “Two-Earners/Multiple Jobs Worksheet.” This section of the form is used to make sure individuals avoid having too little federal tax withheld in the event they have a spouse or more than one job. Keep in mind that in a perfect world, a properly filled-out W-4 ensures that only the exact amount of federal tax is withheld every pay period. Remember, flubbing this section means essentially giving the federal government an interest-free loan until tax filing time. Still excited for that big IRS check in spring?

It’s an HR best practice to notify employees by December 1 to file a new Form W-4 if their allowances or filing status has changed. Remember that “exempt” status we discussed earlier? An employee can only have that status on file for one year before a new W-4 is required, even if they plan to claim exempt again.

We mentioned it before, but it’s worth repeating this point: while an employee may ask you to help them with their Form W-4, you should never give direct tax advice to employees. Note that there can be serious penalties for withholding too little in taxes. You can simply direct employees to the IRS Publications 505 or 501 for any questions completing the form.

There you have it: all you need to know about the Form W-4! And don’t you dare claim otherwise.

Learn about other critical payroll forms in our new Definitive Guide to Payroll.

See how Namely's flexible solution will help you streamline your HR processes by having your people, payroll, and benefits info all in on place.

Get a demoYou May Also Like

Get the latest news from Namely about HR, Payroll, and Benefits.

Thanks for subscribing!

Get the latest news from Namely about HR, Payroll, and Benefits.

Thanks for subscribing!