IRS Unveils Major Changes to Form W-4

One of the most important payroll tax forms is set for an overhaul—again.

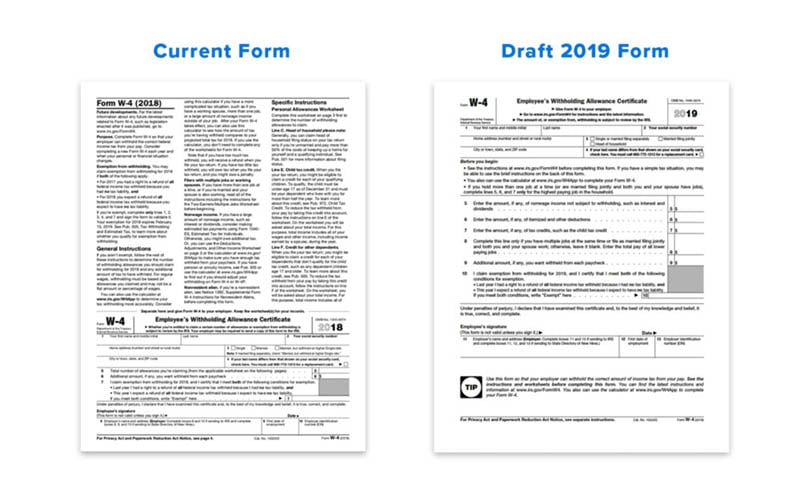

On June 6, the IRS published a draft version of the 2019 Form W-4 to reflect changes made by last years’ historic tax reform bill. The news represents a follow through on agency remarks made at a payroll conference earlier this year. You can read Namely’s coverage of that event here.

Allowances Eliminated

While the full name of the Form W-4 remains the “Withholding Allowance Certificate,” any mentions of tax allowances have been otherwise stripped from the form.

For context, allowances are claims an employee can make to reduce their taxable income. In the past, employees could claim a child, dependent, spouse, or even themselves as an allowance. The form included a personal allowance worksheet that employees could use to calculate how much should be withheld from their paychecks to avoid owing come tax filing season. You can learn more about allowances here.

The new, draft version of the form does away with this decades-old process and the allowance worksheet. In order to determine paycheck withholdings, it instead asks employees to indicate specific dollar amounts for a number of fields including:

-

Nonwage income including interest or dividends

-

For individuals with multiple jobs or those who are married and planning on filing jointly, the total amount earned from other jobs

-

Itemized and other deductions

-

Additional amount employees want to withhold from each paycheck

If an employee feels uncomfortable sharing their nonwage or spouse’s income with their employer, the form instructs them use the IRS’s online calculator to determine how much to include in the additional amount withheld field.

HR Implications

HR and payroll professionals should note that the recently published Form W-4 represents a working draft. The agency is expected to publish a finalized version of the 2019 form by late August.

Given the major implications of tax reform, the IRS has urged taxpayers to “check their check” this year and next to avoid filing season surprises. While the agency has not yet indicated that it will require all employees to file new Form W-4s for 2019, it will likely strongly encourage them to. At a minimum, HR teams will need to update their onboarding process to incorporate the new form.

If you work with a third party to process payroll or manage tax compliance, consult with them to ensure compliance with tax reform. The Namely team will continue to monitor the Form W-4’s status. You can subscribe for updates by clicking here.

See how Namely's flexible solution will help you streamline your HR processes by having your people, payroll, and benefits info all in on place.

Get a demoYou May Also Like

Get the latest news from Namely about HR, Payroll, and Benefits.

Thanks for subscribing!

Get the latest news from Namely about HR, Payroll, and Benefits.

Thanks for subscribing!