IRS Announces 2017 HSA Limits

With one small exception, next year’s health savings account (HSA) contribution limits will remain largely the same.

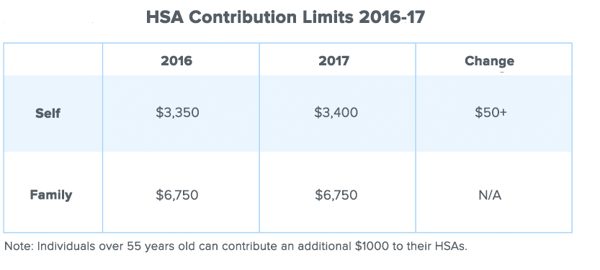

In an April 29 release, the IRS unveiled 2017’s HSA contribution limits—$3,400 for individuals, and $6,750 for families. While the latter rate remains unchanged from this year’s, the new limit for individuals marks a $50 increase.

HSAs act like savings accounts that employees can use for certain medical expenses. The money deposited is untaxed. While participants do not have to forfeit unused funds at the end of the year, there is a limit to how much they can contribute to an HSA every year. The IRS is tasked with adjusting these limits for inflation annually.

In order to be eligible for an HSA, an individual must be part of a health plan with a high enough deductible—$1,300 and $2,600 for individuals and families, respectively. These minimums are also unchanged for 2017.

See how Namely's flexible solution will help you streamline your HR processes by having your people, payroll, and benefits info all in on place.

Get a demoGet the latest news from Namely about HR, Payroll, and Benefits.

Thanks for subscribing!

Get the latest news from Namely about HR, Payroll, and Benefits.

Thanks for subscribing!