941 Payroll Forms - The HR and Payroll Guide to the Form 941

Each year, Americans dutifully complete their annual tax returns to report what’s been paid to the federal government and what might still be owed. Your HR and payroll teams also have their own IRS filing obligations. Employee paychecks are subject to federal income taxes, Medicare, Social Security, and other withholdings.

While companies typically pay these federal taxes on a semiweekly or monthly basis, the IRS still needs a full account of what’s been paid. Enter the Form 941, or the Employer’s Quarterly Tax Return. If it isn’t already, a reminder to complete the four-page form should be on your HR calendar.

Who Needs to File?

Whether you’re a brick-and-mortar small business or a multinational corporation, if you have employees on payroll you’ll likely need to to file a payroll Form 941 every quarter. There are only two exceptions here. If you employ farm workers, you’ll need to complete the Form 943, a version of the same form tailored to the agricultural sector. Additionally, businesses whose withholding obligations amount to less than $1,000 are eligible to instead complete the Form 944, the Employer Annual Tax Return.

When Is the Form 941 Due?

Because the payroll Form 941 is filed on a quarterly basis, HR teams need to be mindful of four separate deadlines. Employers filing the forms will need to do so by the end of the month following the quarter. In other words, your deadlines are:

- Quarter 1: April 30

- Quarter 2: July 31

- Quarter 3: October 31

- Quarter 4: January 31

As an employer, this means you have an entire month to get your payroll Form 941 in order before the deadline hits. If any of the above deadlines fall on a bank holiday or weekend, note that they are pushed to the following business day.

Need even more time? If you make all of your tax deposits with the IRS on time, you’ll receive ten additional days to file. For example, an employer who made timely deposits with the IRS in the first quarter would have until May 10 to file the payroll Form 941.

How Do I Complete the Form?

At the top of the Form 941, you’ll be asked to enter some basic company information. Be sure to have your employer identification number (EIN) handy, as you’ll need it to complete this first part. This nine-digit number acts as your company’s unique identifier for tax filing purposes.

With that out of the way, it’s time to move on to the rest of the Form 941. The bulk of the form is divided into five sections. Below we’ve outlined the purpose of each. Note that all of the information requested here can be easily retrieved from your payroll software.

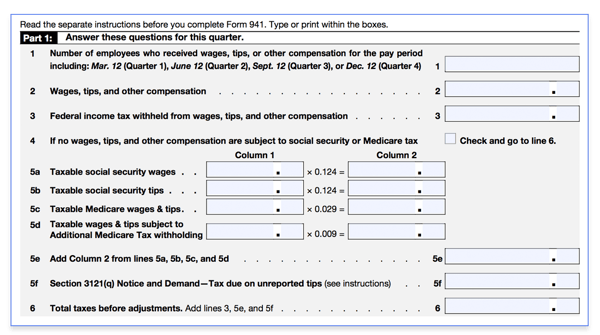

PART 1:

In this section, businesses are asked to specify how many workers were on payroll last quarter and how much they were paid. From there, in box 3 you’ll have to indicate how much total federal income tax your business withheld from these employees.

You’ll then need to include total taxable wages and tips for both Social Security and Medicare, and then multiply both numbers by 0.124 and 0.029, respectively. Add the resulting numbers together to the amount you specified for income taxes earlier (box 3), and you’ll then have your total taxes owed.

From there, you’ll be asked to update the total to account for any one-off adjustments tied to sick pay or life insurance. If this updated amount is higher than the amount you deposited with the IRS over the quarter, you’ll need to calculate the difference. The resulting number is your remaining tax bill.

PART 2:

Remember when we mentioned that most employers deposit their payroll taxes on a monthly or semiweekly basis? In this section of the form, you’ll need to identify your deposit schedule and how much you deposited each time. If you use a monthly schedule, you’ll be able to go ahead and enter this information on the Form 941. If your company makes deposits on a semiweekly basis, you’ll need to attach a completed Schedule B. Filers who need to complete the Schedule B should reference this helpful IRS how-to guide.

PART 3:

If you’re a seasonal employer or are closing down operations, you’ll be asked to say so in this section. If your company is going out of business, completing this sections lets the IRS know not to expect additional payroll Form 941 forms from you.

PARTS 4 & 5:

At the end of the payroll Form 941, you’ll be asked if you want to grant a third party, like a tax preparer or payroll provider, permission to discuss your form with the IRS. You’ll then be asked to authorize the document and indicate your job title in order to confirm you’re actually authorized to sign-off on the form.

Following these sections, you’ll find a voucher form, called Form 941-V. You need to complete this if you end up owing the IRS additional taxes. As with any deposit your business makes with the IRS, remit payment using the Electronic Federal Tax Payment System (EFTPS).

Making it Easy

Penalties for not filing the payroll Form 941 on time can range from 2 percent to 15 percent of the total tax due. Don’t leave tax compliance to chance—working with a payroll provider or third party helps streamline IRS reporting. Today, doing so is more the norm than an exception. Among companies with 500 or fewer employees, 60 percent administer payroll with help from an outside vendor.

Need a place to start your vendor search? Namely processes over $10 billion in annual payroll and handles tax compliance for over 1,000 companies. That's a lot of Form 941s. Learn more about our payroll software or watch a live demo of our platform here.

See how Namely's flexible solution will help you streamline your HR processes by having your people, payroll, and benefits info all in on place.

Get a demoYou May Also Like

Get the latest news from Namely about HR, Payroll, and Benefits.

Thanks for subscribing!

Get the latest news from Namely about HR, Payroll, and Benefits.

Thanks for subscribing!