HR Compliance's Magic Number: Requirements For 50+ Employees

If one is the loneliest number, 50 is the most intimidating for small business’ HR teams. Once your headcount passes the 50 employee threshold, you effectively trigger an avalanche of new reporting and HR compliance requirements.

HR Requirements for Over 50 Employees

When startups make it “over the hill,” fledgling HR teams come of age. Check out some of the key things to be aware of if your business has more than 50 employees.

1. The Affordable Care Act

The Affordable Care Act (ACA) requires employers with more than 50 full-time employees to offer healthcare benefits. Keep in mind that labor laws likely have a slightly different interpretation of full time than what you may be used to. Under the law, employees who work at least 30 hours a week, or 130 hours a month, are considered full time.

If you’re in an industry like hospitality or retail where headcount can fluctuate during the year, the rules are fairly accommodating here. Seasonal staff working less than 120 days a year do not count toward your headcount for ACA compliance purposes.

Once you hit the 50 employee threshold, your company becomes what’s called an “applicable large employer” (ALE). In addition to offering health insurance, you’ll need to demonstrate your HR compliance to the IRS every year by filing Forms 1095-C and 1094-C. Your broker or benefits administration vendor should be able to assist you with these forms.

2. Family and Medical Leave Act

The Family Medical Leave Act (FMLA) requires companies with 50 or more employees to offer its staff up to 12 weeks of unpaid, job-protected leave. The only exception is if your place of business is a public or private school, you’ll need to offer the benefit regardless of headcount.

FMLA leave can be used for certain medical and personal reasons, including, but not limited to:

- The birth or adoption of a child

- A serious illness or injury

- Needing to care for a spouse, parent, or child with a health condition

- Needing to address a personal matter due to a spouse, son, daughter, or parent being called into military service

You’ll also need to hang a workplace poster outlining the benefits and eligibility requirements. Note that several states and cities have their own, more robust labor laws requiring paid leave. Be sure to double-check what your jurisdiction requires.

3. Employee Benefit Plans (Form 5500)

Form 5500 is required for any employer who sponsors a pension or welfare benefit plan covered by the Employee Retirement Income Security Act (ERISA). The form is used to review information on the qualification, financial status, investments, and operations of the plan.

Plans that are subject to ERISA generally include medical, dental, 401(k), and retirement savings. For employers who have passed the 50 employee threshold but remain under 100 employees, there is a short version of the form you might be required to complete instead. The Form 5500 is due the last day of the seventh month after the plan year ends.

Review the IRS page on Form 5500 to learn more.

4. Demographic Reporting

The Equal Employment Opportunity Commission (EEOC) was established in 1965 to protect job applicants and employees from discrimination on the basis of their race, religion, sex, and other protected traits. The EEOC organization requires that businesses over a certain size submit a headcount report including race, gender, and role information on an annual basis.

While private businesses don’t have to worry about demographic reporting until reaching 100 employees, federal contractors need to comply once they hit the 50 employee threshold. Note that the law does not distinguish between full-time or part-time workers. The annual deadline to file the form is March 31.

5. Affirmative Action

Affirmative action plans (AAPs) define a company’s policies and procedures on training programs, outreach efforts, and business practices that promote qualified minorities, women, people with disabilities, and veterans for equal employment opportunities.

Organizations with 50 or more employees and $50,000 in government contracts must have an AAP. For more information on affirmative action HR requirements for small businesses, visit the U.S. Department of Labor website.

6. State and Local Labor Laws

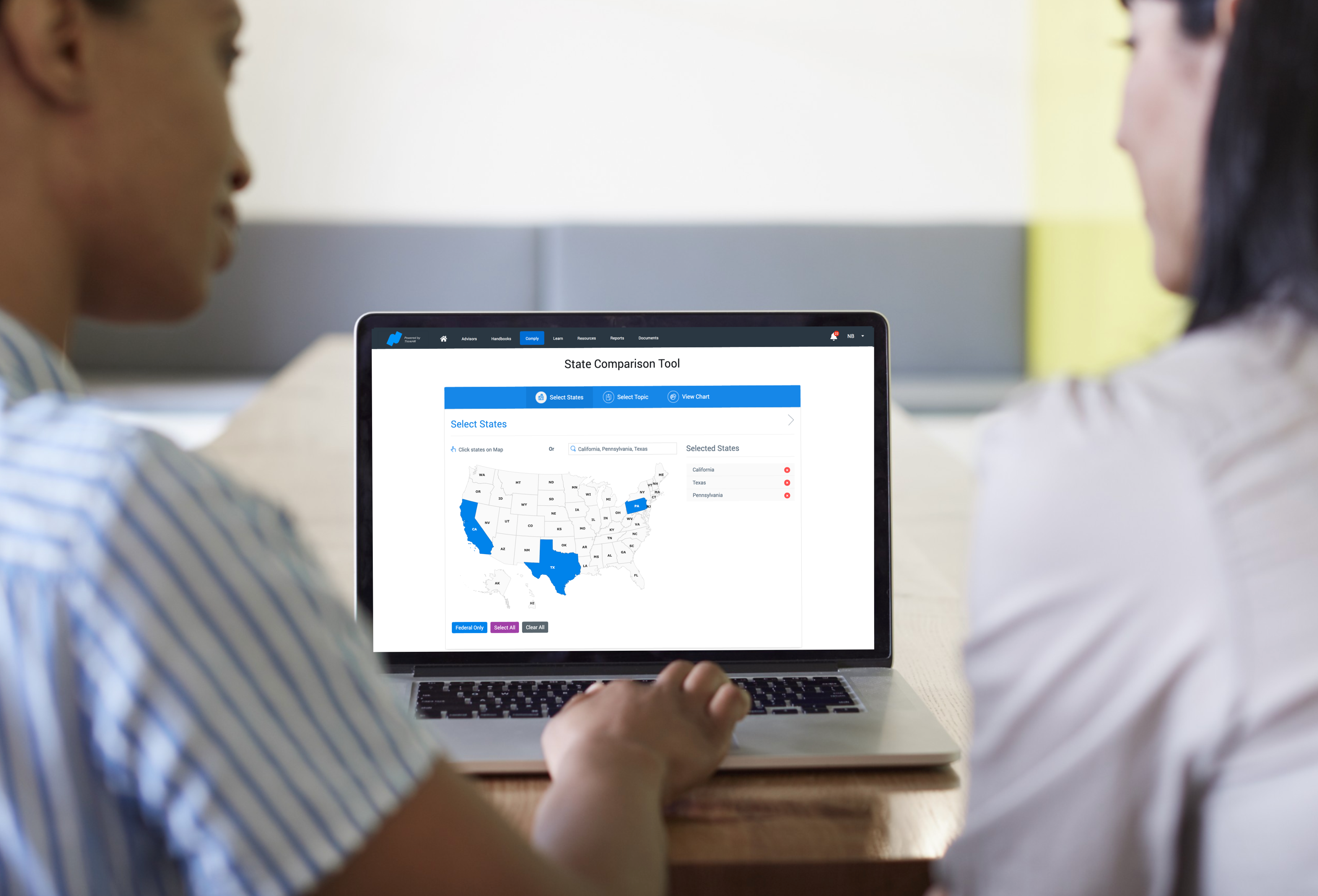

Never assume that you’ll only need to worry about federal employment regulations. State and local governments often impose their own labor laws, many of which are tied to headcount. A growing number of states and cities even have separate minimum wages in place depending on company size.

Need a few examples of local laws that may apply to your business? In California, once you hit the 50 employee threshold you’ll need to put managers through two hours of anti-harassment training every two years. In New York, you’ll need to provide employees with 90 days’ notice for any mass layoffs or relocations.

State and local provisions applied to companies with 50 or more employees are diverse and span all disciplines of HR.

----------------------------------------------------------------------------

As companies approach and eventually soar past the 50 employee mark, their HR teams often stay small. In order to keep up with HR compliance, recruiting demands, and more, these teams need an edge to keep their heads above water.

“Work smart, not hard.” You’ve heard the cliché before. But for small HR teams, it’s a mantra that helps them stay afloat. In our eBook, 17 Hacks For Small HR Teams, we’ve put together a list of the strategies that make these battle-tested HR “armies of one” so successful. Download it today and never bat an eye again at HR requirements for over 50 employees or other HR compliance topics.

See how Namely's flexible solution will help you streamline your HR processes by having your people, payroll, and benefits info all in on place.

Get a demoGet the latest news from Namely about HR, Payroll, and Benefits.

Thanks for subscribing!

Get the latest news from Namely about HR, Payroll, and Benefits.

Thanks for subscribing!